If you click a link in this article, it might be a referral or an affiliate link, meaning I probably get some money or some form of incentive if you register and eventually use the product. This never impacts my editorial recommendations or decisions – if it’s in, it’s in there because I independently rate it and any review or opinion, whether positive or negative, is not affected by any incentive I may or may not receive.

20 December 2023 – I have updated this post to reflect the current boosted referral bonus of £15, instead of £5 – this is correct as at the time of writing and is subject to change, and I may not get around to editing this blog post as soon as it does.

So you may have already heard of Sprive – they promise to help you pay off your mortgage faster, but is it true?

Do you just want free money?

Before I go into the details, if you just want a free £15 (correct as at 20 December – this is temporarily boosted from £5) towards your mortgage, here is my referral link.

My code is 5MKTJNQ6 and if you use this, you can get a free £15 (correct as at 20 December – this is temporarily boosted from £5) towards your payment, which when you calculate the interest saved, is worth a lot more.

What is Sprive?

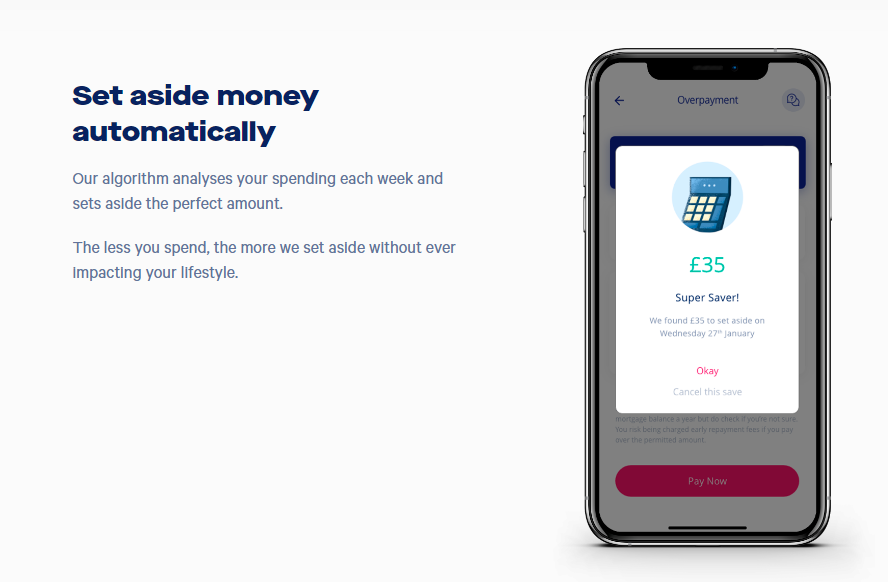

Primarily, Sprive offer an AI solution to mortage overpayments. You set your limits, then each month, they work out how much to overpay your mortgage by based on what you can afford.

Do I need Sprive?

They correctly claim that the more you overpay, the less interest you will pay your lender.

This is completely true, but your bank almost certainly allows you to make mortgage overpayments directly.

You may find the interface of Sprive better, or you may like the automatic saving feature, but you should be able to ask your lender for more details of how to directly make overpayments.

One benefit of Sprive is that you get a visual tracker of your progress – in terms of how much you have overpaid, how much overpayments are worth and also how much of you home you own.

What if I breach my overpayment limit?

Most UK banks allow you to overpay your mortgage by up to 10% of the outstanding balance each year without incurring any charges. However, check your own agreement as products and banks do vary, so this may not be true for yours.

Sprive allows you to set an overpayment limit such that you the AI doesn’t take you over it!

Can I trust Sprive even though it can access my account?

Whether you want to trust them is up to you – I cannot advise on that – but they do claim to have bank-level security and they are FCA registered according to their website.

Should I use Sprive?

If you are somebody who wants to overpay your mortgage, but isn’t organised or strict enough to actually do it, Sprive is a fantastic solution

If you are somebody who is already regularly overpaying your mortage, then you may wish to retain control for yourself – but it is worth grabbing the free referral money!

Is it worth overpaying my mortgage at the moment?

This depends on the best easy-access savings rate which is 3.71% at the time of writing.

To use my own example, my mortgage is currently fixed at 1.86% – as you can see, I can actually earn more in interest by saving than I would actually save in interest by overpaying.

To use a simple example which ignores compounding, for each £100 I save in a year, I will earn £3.71 in interest, whereas I would only save £1.86 in a year if I instead paid this off the mortgage.

If I were to overpay the mortage by £100, then in one year’s time I would have saved £1.86 in interest so my mortgage balance will be £101.86 lower than it would have been without the overpayment

However, if I were to save the money and then at the end of the year overpay the mortage, the balance would be £103.71 lower than it would have been without the overpayment.

You may think that £1.85 isn’t very much, but if you were to save £10,000 in a year instead of using that £10,000 to make an overpayment at the start of the the year, the benefit to you would be £185 – a much bigger sum!

Obviously these examples are based on the interest rates relevant to me.

There are of course other factors to consider. Some people like seeing their mortgage balance go down for example, and lowering their term or monthly payment, but another big downside is that if you save money in an easy-access savings account, you can access it easily (as the name suggests), whereas overpayments are locked into the house.

You may also be able to earn a higher amount of interest with regular saver accounts so it is worth checking them out too.

Do I need to worry about all this if I just want the free money?

No you don’t – if you have read this far but all you care about is a free mortgage overpayment, then just use my Sprive referral link – the code is 5MKTJNQ6.

What other services do Sprive offer?

You can use Sprive to find a cheaper mortage – the benefit of this is that they have a good insight into you and you can easily

I am not sure how they are a mortgage broker – I will be using Better.co.uk when I take out my next mortgage, and using the link in my blog post bags us both a free £100 voucher if you go onto complete a mortage with them.

They offer a free callback too – so even if you aren’t looking for a mortgage at this point and just want some advice, it is worth ringing them or any other broker.

Don’t let this be the deciding factor though and do not use Better.co.uk just because I have written it here – I just mention it because if you will anyway use them, you may as well get a freebie.

Do your own research of paid and free brokers and decide what is best for you – note that some brokers are more helpful than others and depending on your experience, you really want a broker who can advise you on which prodcuts to take, what difference LTV can make etc…

You can also get cashback via Sprive if you purchase gift cards through them but I would check these rates vs other popular gift card sites.

I don’t have a mortgage – can I use Sprive?

No you can’t – you have to link your mortage during the registration process, so this wouldn’t work!

Want to keep up to date with the latest deals and personal finance tips?

Follow me on Instagram, or join my exclusive Whatsapp group for free, or sign up to my mailing list.